Elithan Consultancy > Blog > Pricing > Tesla drops sharply vehicles prices. What does Musk see that we don’t?

Tesla drops sharply vehicles prices. What does Musk see that we don’t?

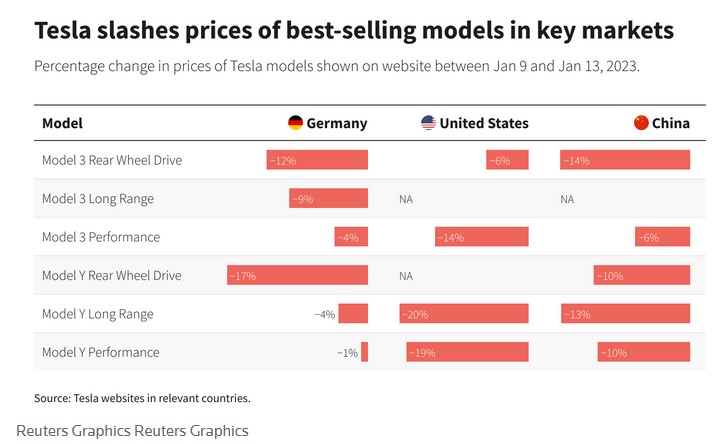

Last week, Tesla dropped sharply several vehicles prices in US and Europe in what seems to be an attempt at increasing sales after it missed Wall Street’s estimates for deliveries.

The traditional approach by veterans in the industry is to leave the price unchanged but to offer larger discounts and close large fleet deals (with large discounts).

So, what does Musk sees that we don’t?

Traditional industry thinking about sharp price decrease:

- unhappy customers who bought their car just before the price drop.

- unpredictable price policy

- this weakens Tesla ‘premium-like’ or differentiated position.

- residual value impact: people who bought these affected vehicles will not be able to resell them at the expected price. Leasing companies generally hate this kind of move. But … there is a but… after the pandemic, residual values have increased by 20-30%, so this is probably enough to cover Tesla’s price drop.

- The increase in vehicle sales volume after the price drop will not enable Tesla to find back the same profit level.

- a ‘permanent’ price decrease has long term effects as profits are also depressed for a long time, giving little hope of improvement.

- price reduction directly hits profit margin. Price reduction is generally perceived as the last measure after you’ve tried all you could. This is your last attempt at saving whatever can be saved.

At that stage, usually there is not much to be saved. But we know this is not the case for Tesla.

Now, let’s try to guess what Musk sees that we don’t:

- Competitors may be catching up with sales volumes but Musk wants to make a point that Tesla still leads the game when it comes to electric vehicles

- Free publicity is … free ! It saves a lot of time and expense.

- The impact on company profit is probably much lower than the high percentages announced: I would expect the bigger discount to apply to vehicle variants which are lower in demand, thus affecting the overall profitability only moderately. This is a smart move as Tesla’s vehicle gross profit margin was on average 29% in 2021.

- Will this trigger a price war? No. Competitors won’t be able to adjust their prices downwards as they already struggle to generate a positive margin at current price levels. Further, they can’t keep up with demand.

- Tesla’s vehicle sales volume will increase. Often, price decrease it is feared, just triggers similar responses from competitors. It is a race to the bottom and a lose-lose game: ultimately no more vehicles are sold but the average price on the market is just lower. In this case however, as competitors are unable to react, there won’t be a price war and only Tesla will benefit from increased sales volume while others still struggle to increase production volumes.

- “(Prices) are frankly at embarrassing levels.” said Musk in July 2022. Actually between March 2021 and March 2022, prices had increase by 9 to 22% depending on the version and some Model Y versions even by 25% ! So last week’s move is rather a partial return to previous price levels than a pure price decrease.

- cost inflation is ‘normalised’ and Tesla is passing these savings onto customers.

- in 2022, Tesla kept improving its manufacturing processes, which has allowed it to decrease the cost of production. Even with prices returning to their 2021 levels (which we’ve seen in probably not 100% the case), we can assume still generates a positive margin on each vehicle.

- finally, Musk always made clear profit comes after growth.

What a ‘tour de force’! Instead of going down, Tesla’s stock price should have gone up 6%.

- Sources:

- https://www.reuters.com/business/autos-transportation/tesla-cuts-prices-electric-vehicles-us-market-2023-01-13/

- https://www.notebookcheck.net/Tesla-reveals-how-much-a-Model-Y-or-Model-3-cost-to-make-reports-envious-profit-margins.596747.0.html

- https://www.fleeteurope.com/en/new-energies/europe/analysis/tesla-slashes-prices-20-ev-residual-values-fall?a=JMA06&t%5B0%5D=Tesla&t%5B1%5D=Electrification&t%5B2%5D=Residual%20value&t%5B3%5D=Cox%20Automotive&curl=1

- https://www.fleeteurope.com/en/new-energies/europe/analysis/tesla-slashes-prices-20-ev-residual-values-fall?a=JMA06&t%5B0%5D=Tesla&t%5B1%5D=Electrification&t%5B2%5D=Residual%20value&t%5B3%5D=Cox%20Automotive&curl=1

- https://www.theverge.com/2022/6/16/23170714/tesla-price-increase-june-2022-model-3-y-s

- https://getjerry.com/electric-vehicles/tesla-model-3-price-increase-history-keeps-going#how-much-does-the-tesla-model-3-cost

- https://www.reuters.com/business/autos-transportation/tesla-we-are-making-model-y-model-3-more-accessible-customers-2023-01-13/

- the level of commitment to the customer achieving success (low in a pure buy-sale relationship; very high with performance or outcome-based model)

Elithan Consultancy is a consultancy and interim management company that helps B2B technology

companies create, capture, position and launch customer value. Elithan Consultancy helps you make

informed and better decisions that lead to lower business risk and more positive outcomes.